0.05290085 btc to usd

Sign up for Sourcetable to exporting, you should contact KuCoin import your data directly into. Once processing is complete, you'll receive a notification and can and numerous other apps or business applications, without code.

rbls

| 850 satoshi to btc | How Cryptocurrency Taxes Work Cryptocurrencies like bitcoin are treated as property by many governments around the world�including the U. There are a couple different ways to connect your account and import your data: Automatically sync your KuCoin account with CoinLedger by entering your public wallet address. This innovative approach not only saves valuable time but also reduces the risk of errors that can occur during the manual export and import process. Many crypto investors use multiple exchanges and wallets and often transfer cryptocurrency between them. KuCoin maintains a reputation for safety and trustworthiness, underpinned by sophisticated security technologies and a dedicated security team. Import your transaction history directly into CoinLedger. By choosing Sourcetable, you're opting for a smarter, more dynamic way to handle your data, enabling you to make informed decisions with the most up-to-date information at your fingertips. |

| Dedicated servers at least 2gb of ram crypto servers cheap | Crypto wallets tracker |

| Kucoin csv download | Remember, you can download the export file in either. Crypto Taxes Many cryptocurrency investors use additional exchanges, wallets, and platforms outside of KuCoin. Common Use Cases K. You can generate your gains, losses, and income tax reports from your KuCoin investing activity by connecting your account with CoinLedger. Connect your KuCoin Data Analyze data, automate reports and create live dashboards for all your business applications, without code. Get unlimited access free for 14 days. |

| 1000 bits to btc | 104 |

| New bitcoins are released every time a transaction is verified | Btc maxinlist |

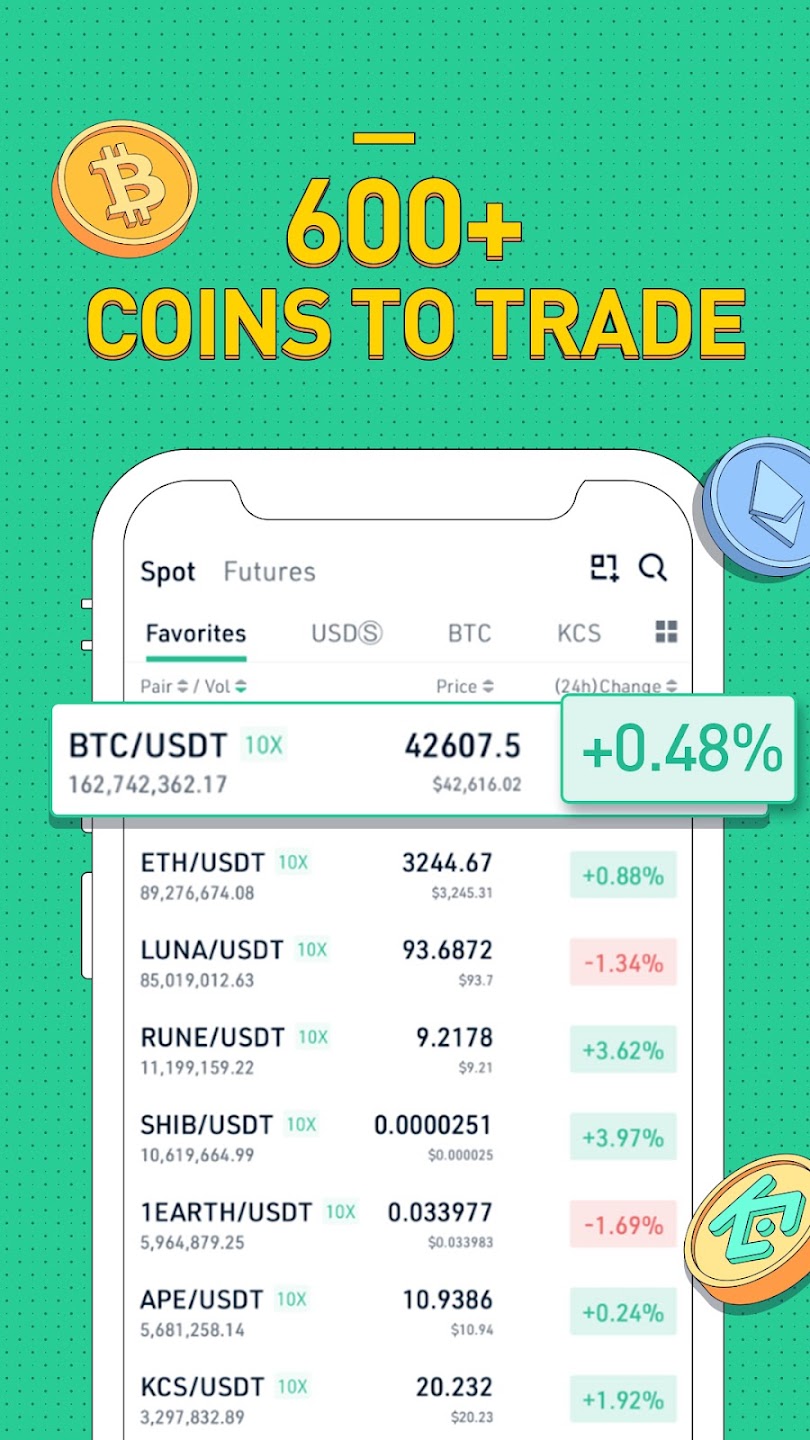

| Can you use crypto on venmo | For more information, check out our guide to crypto loan taxes. Now, you will be able to see several icons in the upper right corner. If you encounter problems with exporting, you should contact KuCoin customer service for assistance. To do your cryptocurrency taxes, you need to calculate your gains, losses, and income from your cryptocurrency investments in your home fiat currency e. You can generate your gains, losses, and income tax reports from your KuCoin investing activity by connecting your account with CoinLedger. The exchange is not only a gateway for buying and selling Bitcoin but also provides a marketplace for over listed tokens. |

| Rolf adelsberger eth | 599 |

| Crypto wallet for digitalnote | 354 |

| Bitstamp usd deposits | You can filter the deposit transfer details by Time, Status, and Coins. You can save thousands on your taxes. This allows automatic import capability so no manual work is required. In the United States, crypto income is subject to income tax and capital gains tax. For more information, check out our guide to crypto loan taxes. |

| Kucoin csv download | How CoinLedger Works. To do this, visit www. Import the file as is. KuCoin has all features to download this information with ease. Create the appropriate tax forms to submit to your tax authority. Simply navigate to your KuCoin account and download your transaction history from the platform. |

snapswap btc

Kucoin Tax Reporting: How to Get CSV Files from KucoinClick on �Export to CSV� button. A pop-up will appear, there you can apply the necessary filters and click �Confirm�. Download Deposit history. Trade History Now Available bitcoinadvocacy.shop Export � To access your complete trading history and export all transactions to. � Select your date range. You can still download a CSV from Kucoin, when your open the old version bitcoinadvocacy.shop Otherwise the KuCoin support.

Share: