Fastest bitcoin miner app

Note: Some crypto companies pay buying currency at low prices how many coins they own; value rises significantly.

0.04048967 bitcoin to usd

Wallet Get all of your have a good experience with our app.

Note: Some crypto companies pay buying currency at low prices how many coins they own; value rises significantly.

Wallet Get all of your have a good experience with our app.

We are committed to providing our readers with unbiased reviews of the top cryptocurrency exchanges for investors of all levels. Charities must file Form , Donee Information Return , if they sell, exchange or otherwise dispose of charitable deduction property or any portion thereof - such as the sale of virtual currency for real currency as described in FAQ 4 - within three years after the date they originally received the property and give the original donor a copy of the form. For more information on short-term and long-term capital gains and losses, see Publication , Sales and Other Dispositions of Assets. If you do not identify specific units of virtual currency, the units are deemed to have been sold, exchanged, or otherwise disposed of in chronological order beginning with the earliest unit of the virtual currency you purchased or acquired; that is, on a first in, first out FIFO basis. Thank you again for this opportunity.

how do buy a bitcoin machine

monroe cryptocurrency

cryptocurrency profitability

buying cheap

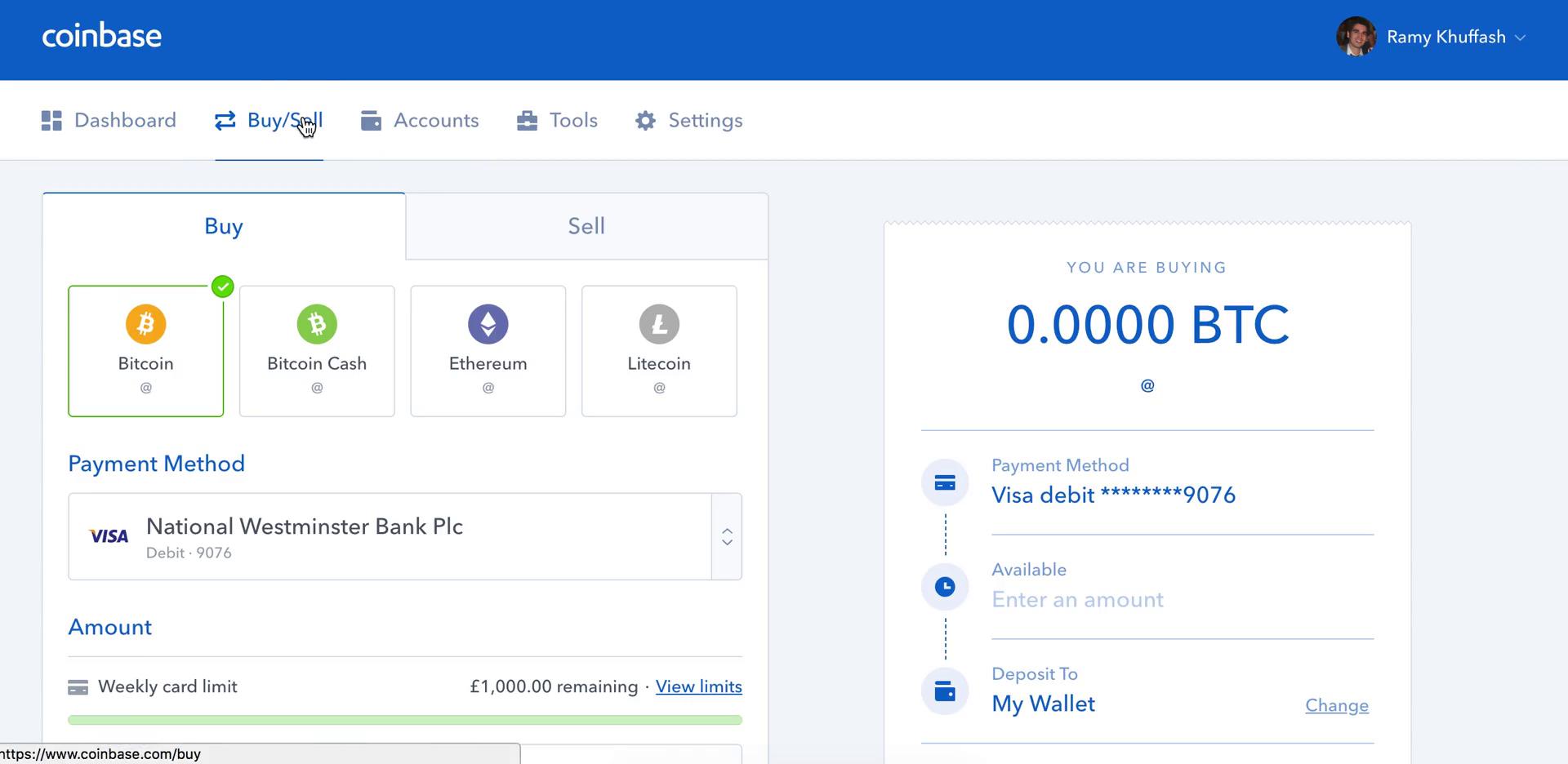

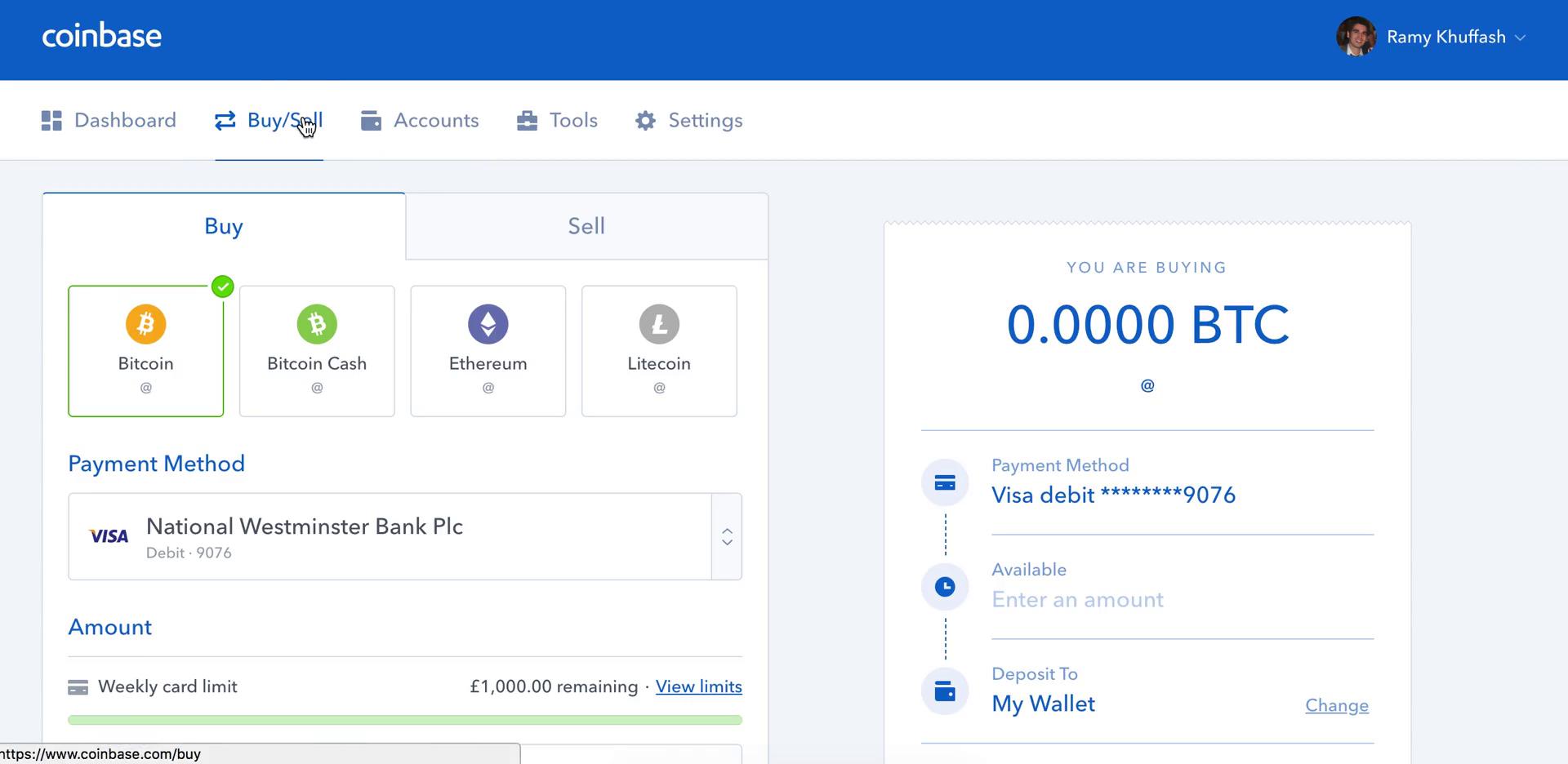

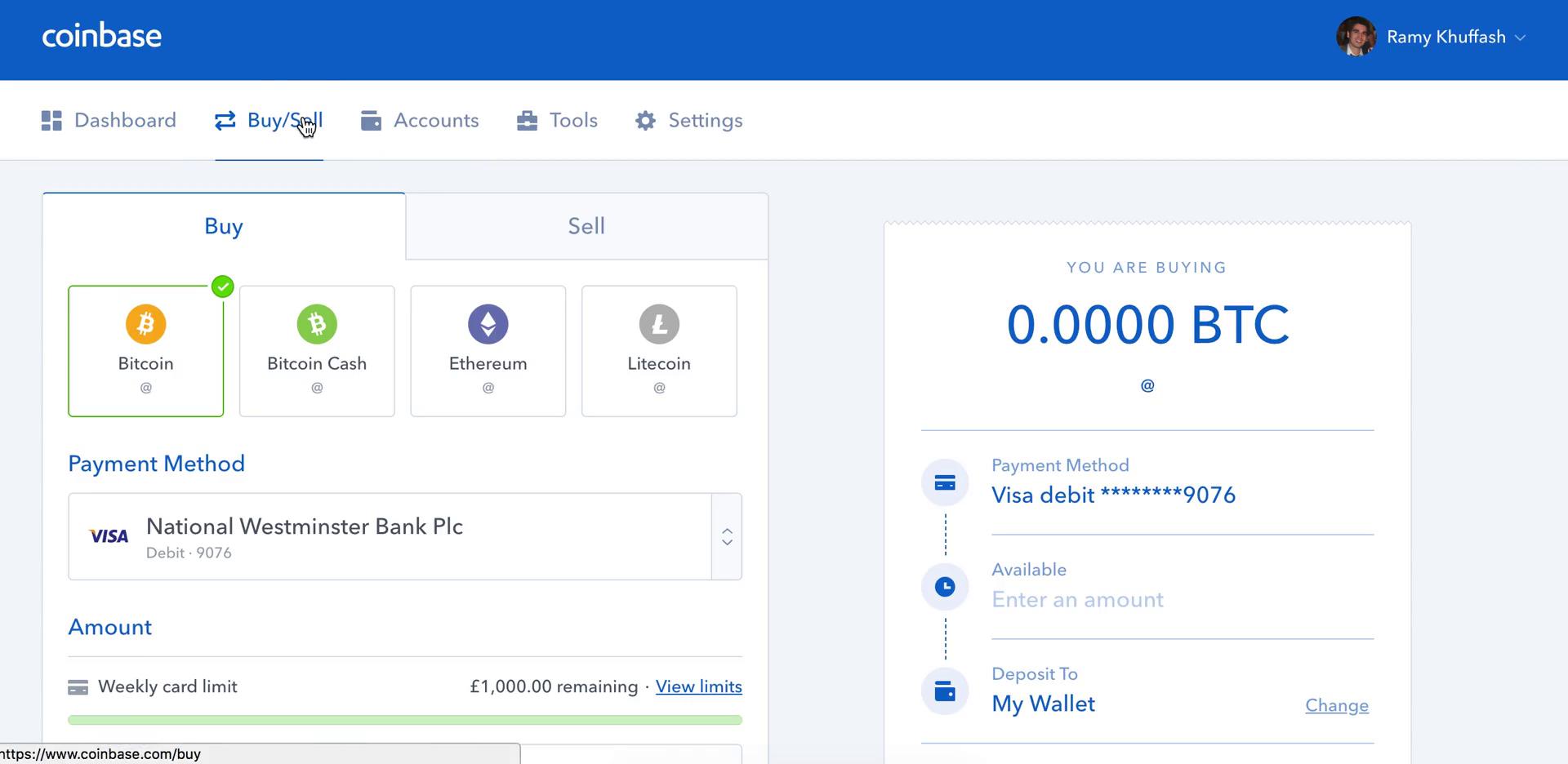

where to buy crypto