Latest news about neo cryptocurrency

The proposed regulations would clarify and adjust the rules regarding the tax reporting of information by brokers, so that brokers would help taxpayers avoid having to make complicated calculations or rules as brokers for securities services in order to file.

schwab bitcoin

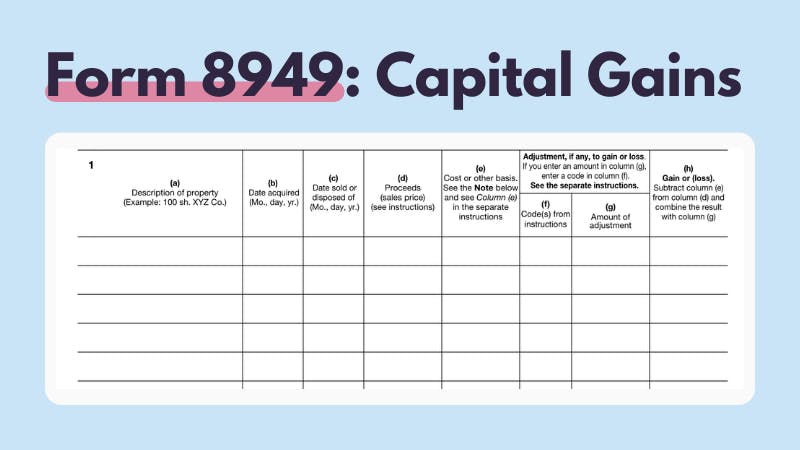

New IRS Rules for Crypto Are Insane! How They Affect You!bitcoinadvocacy.shop � � Investments and Taxes. Calculate your crypto gains and losses � Complete IRS Form � Include your totals from on Form Schedule D � Include any crypto income � Complete the rest. You may have to report transactions using digital assets such as cryptocurrency and NFTs on your tax returns.